The Changing Landscape of Treasurer Expectations

2/15/2017

The Changing Landscape of Treasurer Expectations: What You Should Do Nowby Tom Mitchell

“Times have changed” is a common expression that likely everyone has used to relate to our business and personal lives. Do you remember how you functioned without a smart phone? How about when you came into the office and the word “fraud” was never used? Today, it is a regular part of the job vocabulary for fiscal officers.

The legislature is asking the auditor’s office to expand its reach. House Bills 459 and 384 push for performance audits of ESC’s and colleges. A Public Integrity Assurance Team (PIAT) has been formed to provide a central source for investigation of fraud in government.

What is happening? The regulators are cracking down and further driving accountability. Treasurers are increasingly being held accountable for losses, even when it is not a DIRECT result of their actions. As a matter of fact, the focus has shifted away from related actions and more to the INACTION of fiscal officers.

In the January 2017 issue of SBO Quarterly, there was an excellent article that helped to clear up your Insurance coverages (Findings for Recovery: Understanding Your Coverage is Critical). While that article helped you understand what coverages provide protection to the school and the fiscal officer, the focus here will be on accepting responsibility and taking action to reduce exposure and risk.

Continued Reinforcement of Expectations

While fraud is not new, the regulators are driving for ever increasing accountability and oversite from the Fiscal Officer. We have all known for a very long time that a financial audit is not intended to find or prevent fraud. It is primarily focused on ensuring the credibility and accuracy of the financial statements. So who IS responsible for the prevention? In short, any public official that oversees funds (including if their subordinate oversees such funds) is personally responsible for the protection of those funds.

Ohio Revised Code 9.39

“All public officials are liable for all public money received or collected by them or by their subordinates under color of office.”

Attorney General Opinion, 80-074 (1980)

“Public officials controlling public funds or property are liable for the loss incurred should such funds or property be fraudulently obtained by another, converted, misappropriated, lost or stolen...”

When examining many recent audit reports, we find that these statement along with other cases that define the responsibility and accountability of the fiscal officer are often sited. A review of the Auditor of State Findings for Recovery Database also shows that the state is not taking the responsibilities bestowed upon a treasurer lightly.

Unintended Consequences – Decline in Reporting

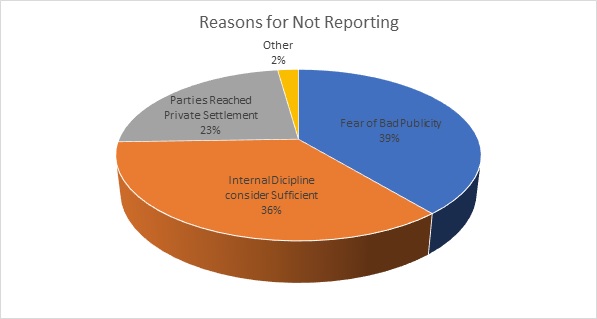

According to the 2016 Report to the Nations published by the Association of Certified Fraud Examiners, “Cases that were referred to Prosecution/Law Enforcement have decreased from 65.2% to 59.3%.” There continues to be three primary reasons cases are not reported from these surveys.

Lack of reporting that leads to a second offense could certainly create a liability situation for an administrator. In many ways, the treasurer is responsible for preventing, finding, and mitigating the issue. Don’t fall into this trap. Let the proper authorities determine if prosecution is appropriate.

Prevention Measures

We have all heard the phrase, “An apple a day keeps the doctor away.” While not intended to be literal in nature, the saying tells us that taking our own actions can prevent longer term issues. This very much applies to the world of a treasurer today.

Once a treasurer reaches that pinnacle moment of acknowledgement that this burden is quite significant, it is time for action. We recommend the exercise of thinking through what your response might be in a post-fraud interview with an auditor.

In our fraud analysis research, it is common to hear such statements as, “I gave the responsibility to… I trusted them.” We have also heard, “I wasn’t aware of this activity.” If you would make such statements in your circumstances, then it could send up lack-of- awareness flags.

In a few examples, treasurers were able to say, “I became suspicious when I noticed ….so, I contacted the auditor’s office.” This statement positively positions the treasurer and supports initiative and awareness. The outcomes are quite different from an accountability perspective.

Actions you can and should take now demonstrate efforts to help defend the funds you are accountable to protect:

| Action | Purpose | Practical Steps |

| Review and Understand Board Policies | Much of an audit is a review of what was supposed to be done in comparison to what was actually done. Reading and knowing board policies helps clarify the expectations the district imposed upon itself. | Set aside 1 hour per year to read the policies behind closed doors with a critical eye on oversights. |

| Encourage Whistle Blowers | Your own employees are your biggest asset in fight against fraud. Make sure they are comfortable knowing their protections. | Send a broadcast email NOW with the Auditor’s Hotline letting district-wide staff know the serious intent to prevent fraud. We have samples available at no cost. |

| Update the Board on Treasurer Controls | Provide transparency and request BOE input and approval. | Create a presentation that outlines important financial controls. Spend 30 minutes with the board helping them understand the controls and getting feedback. |

| Perform Unannounced Control Reviews | Don’t depend on annual audits to find flaws in your operation. Before an audit, apply your own expertise and critical review to find better ways to manage vendors, payroll processes, and segregation of duties. | Conduct ‘sit-in’ visits with staff while they perform tasks that are fraud susceptible. Staff enjoys knowing you care about their work and you get to see where improvements are possible. |

| Evaluate Technology that can Provide Automation in a Control Environment | There is far too much to do and far too little time to get it all done. As such, adding manual controls is difficult to fit into the work day. Evaluation of technology that can streamline control processes will help to mitigate risk. | Review bank offerings such as positive pay, evaluate the effectiveness of reporting generated in your ERP system. Get rid of what you don’t use and find a few things you can use daily. Consider data mining solutions that can provide continuous monitoring of the payables processes. |

Redefining the Your Role

The message is loud and clear. The expected role of the fiscal officer is less about the associated tasks and much more about effectively protecting the district’s assets through leadership as well as establishing and implementing controls. Don’t hesitate to embrace the expectation of this re-defined role.

Rate this news